Your new post is loading...

Your new post is loading...

|

Scooped by

Prentiss & Carlisle

February 8, 2012 9:18 AM

|

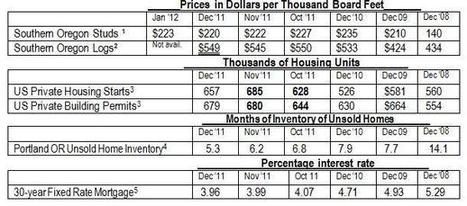

Prices of lumber, logs, housing, and mortgage statistics show the four-year dilemma of painfully slow progress out of this deep depression in lumber and housing.

|

Scooped by

Prentiss & Carlisle

February 8, 2012 8:49 AM

|

Wood chip exports from Latin America are on track to reach a record high of almost eight million tons in 2011, reports the Wood Resource Quarterly.

|

Scooped by

Prentiss & Carlisle

February 5, 2012 10:00 AM

|

The Pacific Forest Trust and Roseburg Resources closed on a working forest conservation easement on the 8,230-acre Bear Creek Working Forest in Siskiyou and Shasta counties....

|

Scooped by

Prentiss & Carlisle

February 3, 2012 9:29 AM

|

An independent report has found that the Tasmanian forest industry is under severe pressure because of the collapse of international woodchip markets. The report concludes that a series of factors have led to the collapse of woodchip exports to Japan and the Government can't say when new markets to China are likely to emerge. ...

|

Scooped by

Prentiss & Carlisle

February 2, 2012 5:02 PM

|

Prentiss & Carlisle is one of the largest timberland asset managers in North America. P&C provides ongoing management services on approximately 1.75 million acres of timberland located in Maine, Michigan, New York, Vermont, Wisconsin, Ontario and Quebec. Nearly every acre under management is certified by the Forest Stewardship Council through either our clients or through P&C itself, which holds FSC certificates for both Forest Management and Chain-of-Custody. P&C provides turnkey land management from long-range forest planning through on-ground forestry, marketing of forest products, harvesting, transportation, road construction and maintenance, stump-to-mill accounting and reporting, client cash management, administration of third-party relationships, public advocacy/representation and strategic asset planning. P&C also provides specialized consulting services in related areas of expertise: - Timber inventory design, execution and analysis

- G&Y modeling and timber harvest scheduling

- GIS mapping and data management services

- Timberland valuations and appraisals

- Acquisition and disposition due diligence

- Market studies

- Timber supply modeling

About this magazine Our aim is to provide a gathering place for news and opinion about timberland investing. We cover both publicly traded issues including listed timber companies, real estate investment trusts (REIT's), and exchange traded funds (ETF's), and the more private world of institutional investing in timberland. Our focus is on: the rationale for investing in timberland; performance of publicly traded timber investments; timberland deals and transactions; timber supply, demand and prices, and; public policy issues that impact timberland investing. Not interested in all of these topics? You can easily filter the stories by using the Tags button above. We encourage readers to interact with our site: - Click on the Follow button (upper left), and Scoop.it! will deliver a summary of our new content to your inbox every morning.

- Click the Share button above or at an individual story to Tweet or post a link on Facebook.

- Click the Suggest button above to propose content for inclusion in the magazine. If the story is accepted, you will be credited as the source with a link that can drive traffic to your own website, Facebook page, blog, etc.

Some useful links Stock quotes, news and financial metrics These links take you to customized Google Finance pages for timber REITS, indexes and other publicly traded companies of interest: Prentiss & Carlisle newsletters Quarterly updates on conditions in our operating regions Timber Mart North Lake States price reporting service published by P&C

|

Scooped by

Prentiss & Carlisle

February 2, 2012 11:26 AM

|

The town of Newcomb in the central Adirondacks bought three parcels totaling 348 acres for $256,591 from The Nature Conservancy. The parcels were part of the conservancy's 2007 purchase of 161,000 acres of Finch, Pruyn & Co. timberland. The group sold 92,000 acres of the tract to ATP Timberland Invest in 2009 and sold conservation easements on 89,000 acres to New York state in 2010.

|

Scooped by

Prentiss & Carlisle

February 1, 2012 11:30 AM

|

Some of Rick Holley's comments on the investment timberland market are worth quoting at length:

"The attractive features of timberland investment remain in place biological growth, inflation hedge and a low correlation of returns to the equity markets. As a result, demand for industrial timberlands remains healthy, and investors continue to allocate capital to timberland assets.

Those of you who have actively followed the timberland markets know there hasn't been much industrial timberland offered for sale in the market over the past 3 years. The state of affairs is primarily driven by the fact that there are not many natural sellers of timberland in the market today. During the past decade, investors became accustomed to a higher level of activity in timberland transactions than we think will occur in the future.

The activity level in timberland markets from the mid-1990s up to roughly 2008 was an anomaly and driven by a fundamental restructuring of the forest products industry. Competition for the assets and a transitioning of the marginal buyer from a taxable C-corporation entity to a tax-efficient buyer increased the pricing efficiency of the timberland market.

Even as some of the timberland investment funds mature over the next decade, we think that the pace of timberland transaction will remain well below the levels seen during the restructuring period. In examining recent transactions, we've seen pricing of some deals that incorporate not only a cyclical recovery in the log prices, but also anticipate additional improvement in log prices from the structural changes in supply and demand that are expected to take place in North America timber markets. So some buyers appear willing to pay today for the full menu of cyclical recovery, inflation and structural supply and demand shifts."

|

Scooped by

Prentiss & Carlisle

January 31, 2012 10:49 AM

|

Ohio State Highway Patrol Retirement System, Columbus, named RMK Timberland Group, Forest Investment Associates and Timberland Investment Resources as finalists in its search for a timber manager to run about $29 million, confirmed Mark Atkeson, interim executive director.

|

Scooped by

Prentiss & Carlisle

January 30, 2012 2:46 PM

|

... With the economy growing at 10 percent per year, it has been hard for the domestic Chinese forestry industry to keep up with demand, and pulp imports increased by over 43 percent between 2008-2009. By 2015 the country’s timber consumption is expected to reach 340 million square meters, over twice China’s annual production.

The Chinese government reacted with its Forest Industry Development Plan (2010-2012), which aims to increase domestic production of wood fiber by 12 percent each year, supporting, through subsidies and favorable state loans, the development of integrated plantation-pulp-paper systems ...

|

Scooped by

Prentiss & Carlisle

January 28, 2012 4:20 PM

|

"...As part of this repositioning, the company expects properties may be sold in bulk, in undeveloped parcels, or at lower price points."

St. Joe owns 577,000 acres in the Florida panhandle.

|

Scooped by

Prentiss & Carlisle

January 26, 2012 8:58 AM

|

WASHINGTON — The Obama administration says new rules to manage nearly 200 million acres of national forests will protect watersheds and wildlife while promoting uses ranging from recreation to logging. ...

|

Scooped by

Prentiss & Carlisle

January 20, 2012 2:08 PM

|

The U.S. Forest Service announced today that it is granting $52.2 million for 17 conservation and working lands projects across the U.S. in 2012. The Forest Legacy Program has protected 2.2 million acres through public-private partnership using federal and leveraged funds of more than $562 million. The program works with private landowners, states and conservation groups to promote sustainable, working forests.

|

Scooped by

Prentiss & Carlisle

January 25, 2012 10:48 AM

|

The St. Joe Company (St. Joe) is a real estate development company. The Company owns approximately 577,000 acres of land concentrated primarily in Northwest Florida. St. Joe is engaged in town and resort development, commercial and industrial development and rural land sales. It also has interests in timber.

|

|

Scooped by

Prentiss & Carlisle

February 8, 2012 8:59 AM

|

Stafford is a timberland fund of funds investment firm, investing internationally on behalf of sophisticated institutions. ...

[Editor's note: our "Featured TIMO" series does not imply an endorsement of the subject organization. It is presented only to help educate readers about this corner of the Timberland Investment space.]

|

Scooped by

Prentiss & Carlisle

February 6, 2012 9:42 AM

|

Weyerhaeuser Company ( WY ) reported its financial results for the fourth quarter and fiscal year 2011 on February 3. ... For the first quarter of 2012, management anticipates that Timberlands earnings would be higher sequentially, attributable to higher selling prices and fee harvest volumes for western logs. However, fuel costs and silviculture expenses are expected to be higher.

COMPARE REIT's: http://goo.gl/UJT3J

|

Scooped by

Prentiss & Carlisle

February 4, 2012 11:10 AM

|

Importation of softwood logs and lumber to China has increased continuously over the past 15 years, and in 2011 the country was the largest importer of softwood lumber and logs in the world, according to the Wood Resource Quarterly.... ...

|

Scooped by

Prentiss & Carlisle

February 3, 2012 8:51 AM

|

Cambium Global Timberland has reached an agreement on the purchase price adjustment for the sale of the remaining 7,270 acres of land around Corrigan, Texas, which has been impacted by the "Bearing" fire. The sale price agreed is $9.15m.

|

Scooped by

Prentiss & Carlisle

February 2, 2012 11:38 AM

|

"Economic conditions remained challenging throughout 2011, which is reflected in our fourth quarter and full year results," said Michael Covey, chairman, president and chief executive officer of Potlatch Corporation. "For full year 2011, earnings from continuing operations were $40.3 million, which was comparable to 2010. In our Resource segment, we experienced varying conditions between our regions. Demand remained strong in our Northern region, which kept timber prices and harvest volumes at favorable levels. In fact, we were even able to shift a portion of our harvest from the Southern region to the Northern region to capture better pricing opportunities. In our Southern region, fiber availability due to dry weather kept prices depressed most of the year, which was the primary driver of our harvest deferral. Wood Products had a solid year, with operating income and shipments comparable to last year, and Real Estate had another very good year in 2011, with four large non-strategic timberland sales and continued steady demand for HBU and rural real estate properties," concluded Mr. Covey.

COMPARE REIT's: http://goo.gl/UJT3J

|

Scooped by

Prentiss & Carlisle

February 2, 2012 8:47 AM

|

"An independent committee investigating fraud allegations at the TSX-listed company has failed to provide definitive answers regarding the timber firm’s assets and relationships with key business partners. ... Sino-Forest, which had less than $600-million in cash in November, has said it is considering selling assets or the entire company. However, it is also unclear how Sino-Forest can sell timber assets without an independent verification of their value. The independent committee’s report said a third-party consulting firm has, so far, verified just 150 hectares of forest assets in China’s Yunnan province. Sino-Forest has said it controls more than 800,000 hectares of timber."

|

Scooped by

Prentiss & Carlisle

February 1, 2012 11:24 AM

|

Sydney investment manager New Forests announced Tuesday the completion of its A$156 million acquisition of the Taswood softwood plantation estate, on behalf of the Australia New Zealand Forest Fund.

|

Scooped by

Prentiss & Carlisle

January 31, 2012 8:48 AM

|

CEO Rick Holley said income from continuing operations fell during 2011 compared to the year before as lower prices for timber in the South offset increasing profits from timberland in the North.

Holley said the company does not expect a significant rebound in the economy or housing market during 2012. But the company expects to boost its cash flow by harvesting more timber and selling real estate.

|

Scooped by

Prentiss & Carlisle

January 28, 2012 6:44 PM

|

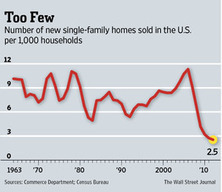

New home sales in 2011 hit their lowest level on record, but it's difficult to express just how bad that is. ...

|

Scooped by

Prentiss & Carlisle

January 28, 2012 10:43 AM

|

Wells Timberland REIT filed an 8-K on Tuesday, January 24th, where it quietly announced that its advisor, Wells Timberland Management Organization, LLC (Wells TIMO) had permanently "discharged" $25.1 million in accrued and unpaid management fees and expense reimbursements.

|

Scooped by

Prentiss & Carlisle

January 25, 2012 3:58 PM

|

Chairman's Statement

Cambium’s goal is to provide investors with a total return from a diversified timberland portfolio. The period covered by these financials was a difficult one for many timberland owners including Cambium Global Timberland Limited. The Company’s net asset value ("NAV") as of 31 October 2011 is 71 pence per share compared to 78 pence per share at 30 April 2011. A dividend of 3 pence per share was paid during the period. Returns for the period were -5.9%.

The negative impact of revaluations on the appraised value of the portfolio contributed -4.9% of attribution to the return. Primary drivers were an adjustment in the value of the Corrigan property in the United States due to loss from fire, timber value of the remaining property in the United States and land prices in Brazil.

|

Scooped by

Prentiss & Carlisle

January 25, 2012 3:51 PM

|

It was a stroke of misfortune I won't forget, made the more memorable because it didn't have to happen: I lost a bundle on Sino-Forest. ...

|

Your new post is loading...

Your new post is loading...

Your new post is loading...

Your new post is loading...