Official figures indicate net migration is falling, yet concern among Britons is close to the highest it has been since polling began in 1974

Get Started for FREE

Sign up with Facebook Sign up with X

I don't have a Facebook or a X account

Your new post is loading... Your new post is loading...

Your new post is loading... Your new post is loading...

Its decision comes as the industry says there is a lack of government investment and as the US pressures firms to invest there.

Graham Watson's insight:

Another blow for the life sciences sector, with Astra Zeneca pausing a £200m investment fearing a lack of government support and pressure from the US government to invest there.

It's the second such decision this week, so you might wonder whether this also signals something about the market structure of the sector. Is it purely coincidence that these firms have taken these decisions or has there been some collusion?

Either way, lower FDI, lower investment, lower growth and no boost for the UK's supply-side.

Chancellor calls economy ‘stuck, not broken’ but there are signs her policies have added to the UK’s economic headwinds

Graham Watson's insight:

A Guardian piece on the latest growth figures. It's downbeat, suggesting that recent policy choices have played a part in depressing growth and that the Budget is going to be challenging when played out against this backdrop.

However, I'd caution against undue pessimism; if policymaking were that straightforward, governments irrespective of their political hue would always get such decisions right and what would we have to moan about?

The economy failed to grow following the biggest contraction in manufacturing output for a year.

Graham Watson's insight:

Some concern for the government, lots of point scoring for the Opposition, but does it really matter? Economic growth for July is 0.0%, although for the last three months growth has been 0.2%. That said, there are worries that if the November Budget sees taxes rise, that might further reduce growth.

Clearly, this is a concern: lower growth reduces tax revenues, but the focus on a single month is probably unhealthy.

Top executives say ministers don’t ‘get’ business, they aren’t listening and key decisions are fluffed or take too long

Graham Watson's insight:

Nils Pratley's piece suggests that the current lack of business confidence stems in large part from a lack of faith in the government. The view that the government doesn't 'get' business or that decisions, such as the reform of business rates take too long to implement have deterred investment and that's a concern.

However, I think instead of making this a binary debate - Conservatives get business - simply because they by and large let business do what it wants - and Labour feel the need to be interventionist, is too simplistic.

There should be role for the government in creating market- supporting institutions, but these should be non-invasive, but by the same token business could help itself by being clearer in what it wants and accepting that appropriate regulation is required to protect consumer and worker interests.

Rain Newton-Smith tells chancellor ‘the time for tinkering is over’ and revisit promise not to raise taxes on working people

Graham Watson's insight:

And the lobbying has also begun, with the Head of the CBI writing in today's Guardian asking the Chancellor to go back on the manifesto pledge not to raise taxes on working people, if only because she fears that the only other way to raise taxes is by taxing business. Turkeys never vote for Christmas...

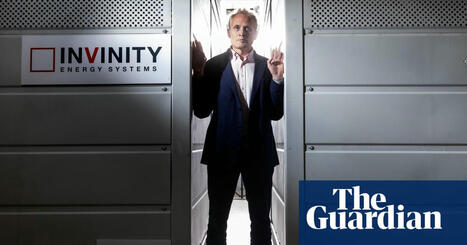

Powering change: UK battery firms aim to unlock the way to net zero | Energy industry | The GuardianCompanies using different technologies for long-duration storage seek funding as country shifts to renewables and requires greater energy security

Graham Watson's insight:

This article could be Microeconomic in that it highlights innovation but given the context of the green transition, renewable energy and energy security, I've put it here. It highlights a range of different UK companies that are exploring how to store green energy and the move away from lithium batteries to alternative metals.

The government anticipates that up to 50,000 new defence jobs could be created by 2035.

Graham Watson's insight:

The increase in defence spending to 2.5% of GDP and the prospect of £250m being invested in 5 local economies highlights the possibility of fiscal policy being used to stimulate growth. Factor in the military connotations of this and it should be easy to see why this strategy has been christened "military Keynesianism".

Most of the cities chosen have obvious links to military production - however, the money going to Sheffield reflects the areas contribution to the supply chain, with the supply of specialist steels.

Older people would save anyway if state support was more limited, and overhaul of council tax would net billions more

Graham Watson's insight:

Phillip Inman presents a suggestion to help the Chancellor resolve some of her concerns over the public finances, arguing that if she scraps pension tax relief, and reforming council tax. Both are going to be unpopular not least with pensioners - or as the article refers to them "Boomers" (the products of the post-war baby boom).

However, from my perspective it's a clever approach in that it does two things - help with the public finances in reducing spending and increasing tax revenues and reducing inter-generational inequality.

The simple fact is that for those of you studying Economics now, this group got free university education, access to the housing market, a lifetime of free healthcare and the benefit of free movement within the EU, all things that are going to be denied you. The problem? They vote. The young, in general, do not.

Companies say increase in employer national insurance contributions has forced them to cut jobs and raise prices

Graham Watson's insight:

Bank of England data suggests that UK firms laid off workers at the fastest pace in four years over the Summer, largely reacting to higher employers' National Insurance contributions.

The data also gives evidence that this move both increased prices and reduced profit margins.

The chancellor hit back at the idea that the government faces so large a gap between spending and tax income.

Graham Watson's insight:

It's clear that the public finances are a concern, and the notion of a fiscal black hole has been with us since Labour's election victory, but to be fair it's largely a consequence of being set up to fail by the outgoing government.

Equally, the size of the 'black hole' is open to debate with the NIESR estimate of £50bn at the thick end of what most commentators think is the case. Nevertheless, it's clear that the forthcoming Budget is going to see tax increases, but much of the surrounding noise is just that: noise.

The government needs bold policies in the autumn budget that will change the narrative without startling the markets

Graham Watson's insight:

This is the really interesting article today - with a prominent former member of the MPC, Sushil Wadhwani looking at the policy measures that the government might look to introduce to address the curent economic situation without spooking bond markets.

The dilemma is how to strike a balance between fiscal credibility and a pro-growth agenda. There are going to be tough decisions taken on tax and spending, not least in how best to raise tax revenue. The suggestion in the article is that a land tax would be best and not affect levels of capital investment. Equally, he argues that the UK should be emphasising the independence of the Bank of England, in comparison with the meddling of President Trump in the affairs of the Federal Reserve.

The interest rate on UK 30-year bonds hits the highest since 1998 as concerns over the economic outlook continue.

Graham Watson's insight:

Government borrowing costs reflected in the bond yield on 30-year government bonds has reached 5.698%, increasing borrowing costs.

The yield has risen because investors want to hedge against increased risk associated with the uncertainty surrounding the public finances, the state of the UK economy and the prospect of tax rises in the Autumn Budget.

However, such a move also has wider macroeconomic implications. |

A report from Policy in Practice says awareness, complexity and stigma are the main barriers stopping people claiming.

Graham Watson's insight:

Ostensibly this is a straightforward story looking at the extent to which people miss out on benefits to which they are entitled. However, I'd use it as a starting point for discussing the extent to which this suggests that benefits fail to reduce income inequality to the extent that they might.

As the article, and the research by Policy in Practice highlights, there are three barriers to claiming benefit: a lack of awareness, the complexity of the system and the social stigma associated with claiming benefit. Indeed, it's estimated that "£24.1bn in benefits and social tariffs will go unclaimed in 2025-26.".

If you want to broaden the perspective, then ask yourself how much is lost in benefit fraud, and if you're feeling particularly fruity you might want to compare that with the amount lost to tax evasion.

Concern for ‘anchor tenants’ as trade body warns that stores could put up prices or cut jobs to protect profits

Graham Watson's insight:

The pre-Budget lobbying has continued with retailers keen to put across their views regarding any potential reform of business rates. In this case, the concern is that any reform is going to massively increase the rates payable by large retailers and the British Retail Consortium is among those arguing that any move that would force the closure of so-called 'anchor tenants' would be counter-productive.

Steve Reed tells the BBC the government is "absolutely committed" to the pledge, which was in Labour's election manifesto.

Graham Watson's insight:

Much as I admire Steve Reed's bravado, I suspect every Minister responsible for housing over the last 40 years has said the same, and have any of them succeeded? I think not.

The firm, known as MSD in Europe, said there has been a lack of investment in life sciences.

Graham Watson's insight:

The decision of US pharmaceutical giant, Merck to cut investment in the UK and relocate its life sciences research to the US is a major blow to a government that is committed to remaining at the forefront of modern technology.

Not only might it mean lower investment and lower growth in future, not least if other firms follow suit, but it might also have adverse supply-side implications too. It may also have spillover effects into other sectors, and comes on the back of Astra Zeneca shelving a £450m investment in a vaccine manufacturing plant earlier this year.

Energy debts have more than doubled in last 12 years, finds report, as Ofgem signals it will raise cap on bills

Graham Watson's insight:

The Resolution Foundation has highlighted the rapid growth in energy debts, with the number of households behind on bills doubling over the last 12 years. This indicates a higher level of fuel poverty and this will only get worse as OFGEM are raising the energy price cap by 2% from October, despite recent falls in the wholesale price of energy.

Ahead of the Autumn budget, the chancellor is limiting access to the Treasury's emergency funds.

Graham Watson's insight:

As is traditional at this time of year, pre-Budget, the squeeze is on, with the Chancellor telling Departments to avoid tapping into to the government's £9bn Treasury Reserve Fund.

It's a move designed to focus minds on spending reductions so that the government can maintain its commitment to its fiscal rules that day-to-day government costs will be paid for by tax income, rather than borrowing by 2029-30 and to get debt falling as a share of national income by the end of this parliament in 2029-30.

Warm weather and interest rate cut lift sales in August, as food, drink and computers perform strongly

Graham Watson's insight:

Retail sales are up, but I don't think that it's cause to break out the champagne just yet. I'd interpret this as suggesting that the economy could be more resilient than we might have thought.

Toblerone and Chocolate Orange also smaller this year after poor cocoa harvests in Africa raise cost of raw materials

Graham Watson's insight:

A good sign of inflation - higher raw materials costs and pressure on profit margins - is shrinkflation, which occurs when food producers look to shrink the size of their products.

In this case, Toblerone is now 20g lighter and a box of Quality Street 50g lighter. Of course, the price of either hasn't fallen, largely as a result of the fact that cocoa prices, whilst currently falling, are still higher than they were prior to 2024.

Sales volumes rose by a stronger-than-expected 0.6% in July, official statistics show.

Graham Watson's insight:

Respite for the government because higher than expected retail sales implies higher than expected growth, but in the grand scheme of things, it also suggests that we've entered another one of those push-me, pull-me phases of economic growth where reading too much into a single piece of data would be lunacy.

Exclusive: Cross-party Poverty Strategy Commission says abolishing limit would be part of its ‘once in a generation’ plan

Graham Watson's insight:

A cross-party Commission - the Poverty Strategy Commission - has made the case for scrapping the two-child benefit cap, arguing that it is the best way of reducing poverty and that it would "lift 4.2 million people out of poverty, including 2.2 million people stranded in “deep poverty”.

The problem is that this comes at a time when the state of the public finances makes such an increase in government spending virtually impossible to envisage.

As date set, chancellor acknowledges UK economy is ‘not working well enough for working people’

Graham Watson's insight:

The date of the Budget has been set for 26 November, a fiscal policy jamboree and an opportunity to use fiscal policy to stimulate the economy. It's clear that there are challenges, not least with regard to the public finances and poverty reduction, and these certainly aren't going to be resolved overnight, but it represents a chance to take discretionary action to affect macroeconomic objectives.

The cost of government borrowing has risen again - what does it mean for the public finances and upcoming Budget?

Graham Watson's insight:

And here's Faisal Islam's verdict on the factors that have driven bond yields upwards because of uncertainty about the state of public finances. However, he notes that its not specific to the UK because of concerns about public finances in the Eurozone.

The wider implications of this are that there needs to be coherence of fiscal policy in next month's Budget to assuage some of these worries. |

Immigration is clearly a controversial issue: however, what is the scale of it and what are its economic impacts. Interestingly, net migration is falling and has halved since 2023, meaning that there are fewer people being added to the labour force, which has supply-side implications. It's also interesting to see that the majority of those entering the country are on work and student visas, and not on small boats as is often portrayed.