Your new post is loading...

Your new post is loading...

|

Scooped by

Trevor Lee @ TravConsult

December 22, 7:23 PM

|

How Chinese beverage brand Mixue successfully scales across emerging-tier cities

🏙️ Lower-tier cities drive Mixue’s nationwide footprint

Mixue’s dominance comes from deep penetration in lower-tier cities, where lower rents and unmet demand support rapid, dense expansion.

🚀 Franchise model accelerates expansion

With ~99% of stores franchised and a relatively low upfront investment, Mixue enables rapid rollout by attracting small operators - especially effective in lower-tier and rural markets.

🏭 Supply-chain control makes model sustainable

Centralized factories and in-house production of about 60% of ingredients allow Mixue to maintain RMB 2–8 pricing with consistent quality at scale.

❄️ IP-led virality fuels mass appeal

Snow King, a viral theme song, and co-branding (e.g., Journey to the West) turn affordability into emotional loyalty and free social amplification.

🌍 Mixue continues global expansion, with recent U.S. debut

Mixue has expanded globally since 2018, starting with its first overseas store in Hanoi, Vietnam, and continuing its rollout with entry into the U.S. market through a store in Los Angeles.

Read more about Chinese beverage brand Mixue: https://lnkd.in/dqF2UxnG

#ChinaBusiness #ChinaInsights #FoodAndBeverage #Mixue

|

Scooped by

Trevor Lee @ TravConsult

December 16, 6:01 AM

|

From –36% to +10%: Adidas’s China comeback is a masterclass in localization. After a sharp downturn in 2022, many questioned whether global sportswear brands could still win in China. Adidas’s performance gives a clear answer: China is not optional, but it must be rebuilt locally.

📈China back in growth mode: Adidas rebounded to EUR 3.5bn in Greater China, delivering +10% YoY growth and contributing ~15% of global revenue. China remains one of Adidas’s most critical growth engines.

🧧 Guochao that travels: Beyond Samba and Gazelle, Adidas wins with “New Chinese” design—Tang suit silhouettes, pankou knots, and CNY drops that resonate domestically and show up on global resale platforms.

🍵Sport meets wellness: The CLIMACOOL teahouse pop-up reframes performance tech through China’s tea and wellness culture, turning a product launch into a cultural experience.

🐶Pets as lifestyle identity: With a China-exclusive pet line and offline “Pet Day” activations, Adidas taps into China’s booming pet economy, where pets are now extensions of personal style and identity.

Winning in China today is about designing, storytelling, and innovating from inside the market. Adidas’s “In China, For China” strategy shows how deep localization can rebuild relevance and growth.

Read more here: https://lnkd.in/ghQbEF7y

#BrandLocalization #Adidas #Guochao #Daxueconsulting #Daxuestories

|

Scooped by

Trevor Lee @ TravConsult

December 14, 7:23 PM

|

Big news: Budapest is getting daily direct flights to Beijing, strengthening Hungary’s ties with China and boosting tourism.

|

Scooped by

Trevor Lee @ TravConsult

December 14, 4:58 PM

|

The Chinese consumer of 2025 is a surgical spender. They’re willing to invest heavily — but only in categories that deliver genuine value.

|

Scooped by

Trevor Lee @ TravConsult

December 14, 4:41 PM

|

How do Chinese consumers choose and book international flights? We surveyed more than 500 Chinese outbound travelers, revealing airline choices, seat preferences, booking habits, and the key factors influencing their flight-booking decisions.

|

Scooped by

Trevor Lee @ TravConsult

December 9, 3:31 AM

|

China Southern signs codeshare deal with Virgin Australia By Li Wenfang in Guangzhou | chinadaily.com.cn | Updated: 2025-12-08 19:45 China Southern Airlines signed a new codeshare agreement with Virgin Australia on Monday to enhance its route network coverage in Oceania.

|

Scooped by

Trevor Lee @ TravConsult

December 8, 10:22 PM

|

India’s workforce grows as China’s shrinks. See how their working-age populations diverge from 2024–2050 using UN demographic projections.

|

Scooped by

Trevor Lee @ TravConsult

November 27, 7:42 PM

|

China’s elderly economy is highly fragmented. Inside the silver economy: generational divides, pension gaps, consumer types, and the 80% low-spending reality.

|

Scooped by

Trevor Lee @ TravConsult

November 26, 7:10 PM

|

This is us with Alibaba Group’s local management in Madrid, building skills to bridge East-West Leadership cultures in a realm that rapidly gains global importance: Chinese firms abroad. The focus? The speed and nuances of communication between European and HQ colleagues at a Chinese firms.

If you read Dragon Suit, you already know my “China in one word” game, which actually encourages people to share their biases about East-West collaboration. China: “Why can’t Europeans reply faster?” Europe: “Why can’t the Chinese provide full replies?”

We spent quite some time in Madrid discussing a specific secret of “China speed”: informal communication through personal channels including random visits and if distance stands in-between, then… Weixin/WeChat of course!

A few great practical lessons from the workshop to both sides:

To Europeans:

- When China calls (or emails), immediately send at least a placeholder in reply, otherwise you may miss the fast train.

- Incomplete replies is the price to pay for speed and agility. Keep asking for input ping-pong style until you get the data you need.

- China is more comfortable with constant changes than you are: confirm next steps in writing at milestones and get an “okay”.

To Chinese:

- Accept slower pace and more transparency as a price for business with the outside world (not just “The West”).

- Include a desired reply schedule in your message. Then check the calendar for weekends and holidays: adjust if needed.

- Learn from customer service pros and ask “Do you need anything else from me?” at the end of your mail or call.

Great thanks Vivian Liu for making the workshop happen, and the whole team for the great thoughts and dynamics!

|

Scooped by

Trevor Lee @ TravConsult

November 25, 11:41 PM

|

For years, brands have been told that China’s next growth opportunities is in its lower-tier markets, with vast populations, rising incomes and less competition. But what is the reality on the ground?

|

Scooped by

Trevor Lee @ TravConsult

November 25, 5:50 PM

|

China’s “multi-terrain” bionic spiders?! 🕷️

The NEW Gen of nature-inspired robots 🦾

Just as the kingfisher inspired bullet train redesign, innovation looks to nature for inspiration.

BUT - this time, coming from spiders?

😳 These intelligent multi-terrain bots are designed to move across complex environments:

- Rubble

- Steep surfaces

- Vegetation

- Uneven ground

Developed by leading research institutions like Harbin Institute of Technology and Tsinghua University. 🎓

+ as well as by emerging robotics companies in Shenzhen.

These multi-legged robots use:

- Flexible joints

- Gecko-like adhesive pads

- Lightweight frames

They are great at navigating spaces that wheeled robots can’t reach! 🤯

Their primary applications are in spaces like:

- Urban search and rescue

- Infrastructure inspection

- Military reconnaissance

They can quietly enter collapsed buildings, tunnels...

OR narrow industrial pipelines to transmit video + environmental data.

The robots went VIRAL on Chinese social media because they look visually striking.

Western viewers sometimes misinterpret these clips as futuristic military weapons... 😅

BUT, most models are research prototypes/inspection tools designed for safety and disaster response!

What do you think of these robot *spiders*?

PS. Want detailed report on Chinese innovation? Get in touch!

Arnold Ma #China #Technology | 14 comments on LinkedIn

|

Scooped by

Trevor Lee @ TravConsult

November 25, 1:17 AM

|

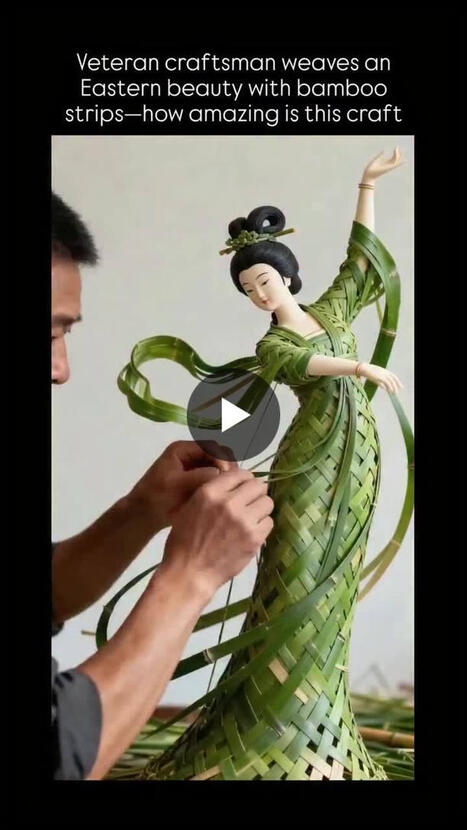

Why luxury and craftsmanship brands should use Douyin (tiktok)to communicate their fabrication.

80% of Western fashion brands and Luxury are missing out Tiktok-Douyin...

🧐

1️⃣ In China, consumers don’t just buy products ; they buy the story behind them

Chinese audiences are extremely curious. They want to see how something is made. They love transparency, emotion, and authenticity.

On Douyin, you can show the world the magic behind the fabric:

- The artisan weaving by hand.

- The texture, the threads, the colors.

- The attention to detail that turns material into art.

- This kind of content doesn’t sell a product ; it sells a heritage.

And in China, heritage = trust = premium value. 💎

2️⃣ Douyin is visual, emotional, and immersive

Luxury is not about logic ; it’s about emotion and aspiration.

Douyin allows you to create short cinematic experiences that capture beauty and craftsmanship in motion.

Imagine:

A 15-second clip of a tailor cutting fine silk with perfect precision.

A slow-motion of natural light on a linen texture.

The sound of scissors, fabric, and focus.

This is not advertising ; this is art direction.

And it’s exactly what attracts high-end Chinese consumers today.

3️⃣ Craftsmanship builds differentiation in a market of noise

China’s digital space is crowded ; everyone is selling, everyone is shouting.

But when you show your process, you are not selling ; you are educating.

That’s powerful.

It says:

“We are not fast fashion. We are slow luxury.”

“We are not manufacturing ; we are creating.”

This resonates deeply with younger consumers, especially Gen Z and Millennials in China who now crave authentic, meaningful luxury.

4️⃣ The Douyin Algorithm loves storytelling

The algorithm rewards videos that retain attention — and the process of creation is naturally captivating.

When viewers stay to watch how a fabric is dyed or woven, your content gets more visibility organically.

It’s algorithmic storytelling : emotion drives engagement, and engagement drives sales. 😉

|

Scooped by

Trevor Lee @ TravConsult

November 24, 7:09 PM

|

China’s 2025 Double 11 (Singles’ Day) shopping festival revealed significant shifts in platform strategies, consumer behavior, and technological integration. This report compiles key data and trends from the event. 1. Did people stop caring about Double 11?

|

|

Scooped by

Trevor Lee @ TravConsult

December 22, 7:06 PM

|

Chinese capital is increasingly flowing into Europe — and not by chance. Behind the acquisitions of European companies and the establishment of assembly or production facilities lies a clear strategy of adaptation to the new global environment.

|

Scooped by

Trevor Lee @ TravConsult

December 14, 9:25 PM

|

In China's aging population, the definition of retirement is changing. Here's how China's silver economy is changing the market

|

Scooped by

Trevor Lee @ TravConsult

December 14, 6:44 PM

|

Chinese Gen Z is a powerful luxury consumer cohort, driven by wanderlust, a cultish approach to community, and unconventional lifestyle aspirations.

|

Scooped by

Trevor Lee @ TravConsult

December 14, 4:54 PM

|

In a push to restore pricing integrity, international brands are battling to end their dependence on daigou — parallel importers who undercut retail prices.

|

Scooped by

Trevor Lee @ TravConsult

December 14, 4:50 AM

|

|

Scooped by

Trevor Lee @ TravConsult

December 8, 10:28 PM

|

Xiaohongshu (RED) has been seen as the poor sales cousin in China. Here’s why I think that’s about to change.

For years, brands have treated RED as the "inspiration platform", great for planting grass (种草), building brand awareness, driving consideration

but when it came to actual sales? Everyone assumed you needed to push people off to Tmall or Douyin to close the deal.

RED was the poor cousin. The discovery engine. Not the cash register.

I think that's about to change. Here's why:

1. RED is doubling down on closing the loop

The platform knows its reputation. And they're aggressively building out native ecommerce functionality.

Better storefronts, smoother checkout, improved logistics partnerships. They don't want to be just the top of the funnel anymore.

2. The audience is premium and ready to buy

RED's user base skews affluent, educated, and willing to pay for quality. These aren't bargain hunters, they're consumers who trust authentic recommendations and value provenance.

If your brand is premium, imported, or ingredient story driven, these are YOUR people.

3. Trust = conversion (and RED has trust in spades)

Unlike Douyin where entertainment drives sales, RED's users come with intent. They're researching. Reading reviews. Comparing notes.

When they decide to buy, they're already 80% convinced.

4. Cross border brands are winning on RED

We're seeing imported beauty, supplements, premium food & beverage, and wellness categories starting to sell up a storm.

Why? Because RED users want more than just the product, they want the story, the ingredients, the "why."

And that's where international brands have a natural edge.

5. The content to commerce gap is shrinking

RED is actively testing features that let users buy without leaving the app. No more "click the link and hope they follow through."

Frictionless purchasing is coming and when it lands properly, watch out.

RED won't replace Tmall or JD any time soon. It won't out-livestream Douyin.

But what it WILL do is become the most effective platform for premium

brands to build authentic community, drive genuine consideration, and increasingly, close sales with high-intent consumers who are tired of algorithm driven noise.

Brands treating RED as "just another awareness channel" are missing the shift.

Brands building real presence, investing in quality content, engaging KOCs authentically, and setting up proper storefronts are positioning themselves for a platform that's about to go 💥

The poor cousin is growing up.

Does your brand play in premium natural or wellness categories?

DM me to find out how you can make your sales 🚀 in China.

-------------------------------------------------------------

I'm Iain Langridge 毅安 and I use my experience in China to launch, grow, and manage premium consumer brands.

#chinamarket #chinamarketentry #chinabusiness #chinamarketstrategy #socialmedia #socialcommerce #exportstrategy In2Asia Export

|

Scooped by

Trevor Lee @ TravConsult

December 2, 10:12 PM

|

What has 2025 taught us about health conscious, non-alcoholic beverage consumption in China?

As we race towards December and look to put a bow on another remarkable year in China's beverage sector, the numbers in the non alcoholic bev space are looking truly remarkable.

China's non-alcoholic beverage market is projected to hit USD 291 billion by 2033, growing at 6.2% CAGR.

But here's what's really interesting

a fundamental shift is occurring in terms of what Chinese consumers are putting in their shopping carts.

The health wave is real (and it's not slowing down)

Better for you (BFY) is now table stakes.

Chinese consumers now expect functional benefits.

Whether it's added probiotics, vitamins, or traditional Chinese medicine ingredients (like chrysanthemum infused beverages), health positioning needs to be authentic and substantiated.

Proof of functionality is a game changer.

Pre & probiotics are booming. International brands with strong scientific credentials have real opportunity here.

If you have lab tests or scientific studies to back your claims, bingo!

What's particularly exciting right now?

Premium sparkling water - urban millennials are increasingly choosing sparkling mineral water over sugary soft drinks.

Brands with strong back stories, demonstrated provenance, natural flavors and elegant packaging are winning in Tier 1 and 2 cities.

We are also seeing beverages incorporating TCM ingredients (goji berry, ginseng, chrysanthemum) trending

Without a shadow of doubt, there is space for international brands to play in this fusion category if done authentically.

However, market entry and the right growth strategy is crucial for success.

China's non alcoholic beverage market heading into 2026 is all about finding premium positioning and owning it.

International brands that win here will combine;

1. Authentic provenance and brand storytelling

2. Premium but not prohibitive pricing

3. Strong ecommerce execution

4. Functional benefits that resonate with health conscious consumers

5. Sustainable packaging (40% of consumers prefer reduced plastic)

The really good news?

Chinese consumers are increasingly willing to pay a premium for quality, provenance, and genuine health benefits.

For the win?

Brands that are willing to respect the sophistication of the Chinese consumer, meet them where they are digitally, and deliver products that genuinely align with their wellness aspirations.

-------------------------------------------------------------

I'm Iain Langridge 毅安 and I use my experience in China to launch, grow, and manage premium consumer brands.

Follow or DM me to find out more.

#chinamarket #beverageindustry #functionalbeverages #marketentry #exportsuccess #healthandwellness #FMCG #probioticbeverages #mineralwater #betterforyou #bfy In2Asia Export

|

Scooped by

Trevor Lee @ TravConsult

November 26, 11:15 PM

|

China is placing greater emphasis on physical fitness in the high school entrance exam, giving rise to a new industry: home coaches delivered right to parents’ doors.

|

Scooped by

Trevor Lee @ TravConsult

November 26, 12:01 AM

|

Things have been looking brighter for brands eyeing China’s lower-tier cities. However a new report paints a vivid picture of daily life on the commercial streets of smaller Chinese cities, which isn’t all rosy. The winners have tailored their offer to the specific needs, habits, and quirks of the l

|

Scooped by

Trevor Lee @ TravConsult

November 25, 6:00 PM

|

From virtual anchors to predictive commerce, China’s AI-driven e-commerce strategies are forcing Western brands to rethink their retail playbook.

|

Scooped by

Trevor Lee @ TravConsult

November 25, 5:49 AM

|

Over the past decade, both China and South Korea have shaped influential cultural movements, but the engines behind them, and the way they expand globally, are fundamentally different.

🎬How Guochao and Hallyu diverge:Guochao has moved from domestic cultural confidence to early global ambition, driven largely by consumer brands aiming to export design and aesthetics. Hallyu, meanwhile, builds on two decades of entertainment-powered soft power, from K-pop to K-dramas, giving it a more unified and global cultural reach.

📱 What they share in common: Both waves are fueled by young consumers. China’s Gen Z shows strong confidence in local brands, while Korea’s MZ Generation is driving global interest in Hallyu, reflected in a rising share of young foreign visitors.

📺Hallyu’s spread: K-dramas and films continue gaining massive traction worldwide, including in China, influencing trends from F&B to lifestyle. This global audience makes product placement in Korean content a strategic tool, even for Chinese brands.

⚠️When Guochao marketing misses the mark: Recent missteps by luxury brands show the sensitivity required when referencing Chinese cultural symbols.Cases involving Dior and Fendi illustrate how misinterpretation or cultural ambiguity can trigger strong public backlash.

Guochao and Hallyu both shape consumer culture, but their foundations differ: one is brand-driven and still evolving globally, while the other is entertainment-driven with established soft-power momentum. Understanding these dynamics is crucial for brands navigating Asian markets and cultural influence.

Read more here: https://lnkd.in/gtVVQRbi

#Guochao #Hallyu #CulturalTrends #DaxueConsulting #Daxuestories

|

Scooped by

Trevor Lee @ TravConsult

November 24, 10:06 PM

|

The most beloved supermarket in China is making too much money? 😳

AND its founder says the company's runaway success is destroying its core value.

Yap, the company’s sales are soaring, yet the founder is begging to slow down.

❗It seems Pang Dong Lai, the most beloved supermarket in China, fears its own runaway success.

The legendary Chinese retailer achieved sales of US$2.5 billion in just nine months of 2025—surpassing its entire 2024 total.

But founder Yu Donglai issued a startling warning: such rapid, unchecked growth forces overtime and undermines the company’s core values.

📌 The "People-First" Model

Pang Dong Lai’s culture is its business model. The company is famous for:

- An average employee salary over $1,260 USD/month —significantly above industry standard.

- No mandatory overtime and generous vacation policies.

- A publicly declared goal of employee happiness.

This philosophy transformed grocery shopping from a chore into a joyful, viral experience built on trust and human warmth.

📌 The Genius Behind the Model

The "soft" values create "hard" business results. Happy, fairly compensated employees provide exceptional service, which builds fierce customer loyalty.

This allows Pang Dong Lai to:

- Curate a dazzling array of products, from dozens of soy sauces to premium imported goods, creating a sense of discovery.

- Build immense trust in its high-quality house brands.

- Become a destination, not just a utilitarian store.

📌 Yu Donglai’s concern reveals the central challenge:

- Can a company scale its soul?

- Is it possible to grow without sacrificing the very principles that made it successful?

- He is actively trying to cap growth to protect the culture.

💬 Can a company's culture truly remain its top priority during hyper-growth?

Pang Dong Lai’s experiment tests a fundamental question for modern business: Is sustainable, human-centric scale the next competitive frontier?

What’s your take?

____

#leadership #retail #pangdonglai #ashleytalks

❌ Still measuring success by revenue growth alone?

✅ DM me to discuss how to build operational strategies that protect company culture during expansion. | 12 comments on LinkedIn

|

Your new post is loading...

Your new post is loading...

Your new post is loading...

Your new post is loading...