Your new post is loading...

Your new post is loading...

|

Scooped by

Beeyond

January 30, 8:57 AM

|

Telco layoffs dominate headlines these days, yet global employment barely flinches.

According to MTN Consulting, total operator headcount reached 4.357 million in 2Q25, down 1.9% year over year, or roughly 84,000 jobs. The quarterly decline averages 18,000 to 22,000 roles, a range that has held remarkably consistent since the early 2010s. The curve did not steepen in 2023. It did not steepen in 2024. It did not steepen after generative AI entered boardrooms.

Global telco employment continues to decline at the same pace before and after AI. No cliff, no inflection, just a long, structural decline.

|

Scooped by

Beeyond

January 28, 8:13 AM

|

Most financial analysts frame 2026 as flat-to-low-growth revenues with improving margins. ING anchors the European view: sales growth around 2% and median EBITDA growth around 2.5%, with the spread explained by cost rationalisation rather than a demand step change.

After a dip in 2025, analyst models show EBITDA growth rebounding above the four-year median in 2026, reflecting the delayed impact of restructuring, automation, and cost rationalisation programs rather than any improvement in underlying demand or capex intensity. Even that 1.5% to 2% revenue growth is a grind. In many competitive markets, operators fight ongoing high price erosion while discounts and value segment pressure keep ARPU fragile. Penetration is above 100% in most countries, which doesn’t leave room for “new customer growth” but rather forces a sum-zero game. That's an expensive endeavour for the consumer market.

Analysts call out exactly that dynamic, with upside coming from bundles and selective price increases, and downside coming from competitive discounting and weak ARPU markets.

|

Scooped by

Beeyond

January 22, 7:40 AM

|

AI is no longer an incremental network feature. It is changing how telcos invest, where traffic grows, and which layers of the infrastructure stack capture value. Over the last 12 to 18 months, operators have moved from isolated AI pilots to coordinated investment across mobile access, fixed networks, transport, and automation software. This shift explains why Ericsson, Nokia, and Huawei are no longer pursuing similar strategies.

Two forces sit behind this change. First, AI traffic growth is reshaping network topology. Training remains centralized, but inference is spreading toward metro, aggregation, and edge locations. This increases demand not only for mobile capacity, but also for fiber densification, high-capacity IP routing, optical transport, and data center interconnect. In many operator budgets, spending growth in fixed and transport now exceeds incremental macro RAN expansion.

|

Scooped by

Beeyond

January 17, 6:25 AM

|

For most of its history, telecom venture capital was symbolic. That changed after 2018 and accelerated sharply after 2022, as tier-one operators and vendors began treating venture investing as a structural tool rather than innovation theater. Competitive pressure, AI-driven compute shifts, and geopolitical risk forced telcos to engage with emerging technology earlier and more deliberately. Today, the ten most relevant telco and vendor-backed venture platforms collectively deploy or manage an estimated $10B to $15B, with annual deployment of roughly $1.5B to $2B. Capital is highly concentrated, and portfolios are tightly scoped around network software, AI infrastructure, cybersecurity, edge compute, silicon adjacencies, private networks, enterprise platforms, and regulated data services rather than consumer growth plays.

|

Scooped by

Beeyond

January 13, 9:08 AM

|

Once standalone reached scale, the industry expected financial performance to diverge between early adopters and laggards. That divergence has not appeared. The United States is the clearest test case. By 2025, nationwide standalone cores were operational, and live traffic was being migrated. If SA were changing monetization dynamics, it should have shown up first in the world’s largest mobile market. Instead, mobile service revenue growth remained modest. AT&T’s mobile service revenues grew 3.4% year over year through the first three quarters of 2025, roughly in line with inflation. Verizon showed a similar profile. Neither operator cited standalone driven services as a material contributor to ARPU or margin expansion. Equity markets reflected the same assessment. Since the launch of 5G in 2019, AT&T’s market capitalization declined by approximately 18%, while Verizon’s fell by about one-third, despite years of network upgrades and SA completion.

|

Scooped by

Beeyond

January 8, 9:20 AM

|

Since 2000, telecommunications operators have paid approximately $1 trillion for spectrum access. Not equipment. Not fiber. Not radios. Just permission to transmit. Roughly $400–450B upfront in primary license awards, $50–100B in clearing and refarming, and hundreds of billions more in recurring spectrum fees paid every year. This is the largest capital and rent extraction in telecom history.

|

Scooped by

Beeyond

January 4, 5:05 AM

|

The idea that telecom networks can be used for weather sensing is not new. GNSS-based atmospheric estimation, rain attenuation on microwave links, and radio refractivity effects have been studied for more than 20 years. The physics is well understood and already embedded in network planning and synchronization systems.

|

Scooped by

Beeyond

December 11, 2025 5:53 AM

|

La proposition a pris corps mercredi avec la publication d’un avis au Federal Register, le Journal officiel américain : l’administration Trump veut désormais exiger des visiteurs bénéficiant du programme d’exemption de visa (ESTA) qu’ils fournissent l’historique de leurs comptes sur les réseaux sociaux sur cinq ans.

|

Scooped by

Beeyond

December 4, 2025 5:00 AM

|

Why Telcos Are Spending Billions on Transformation, Only to Feed the Ghost of Yesterday... The industry is not just underperforming; it is actively using its massive capital expenditure to service the maintenance and complexity of its own past, leading to a permanent state of diminishing returns. The key challenge we are facing is that the problem is not the telco’s technology stack; it is the telco’s DNA.

|

Scooped by

Beeyond

November 20, 2025 8:11 AM

|

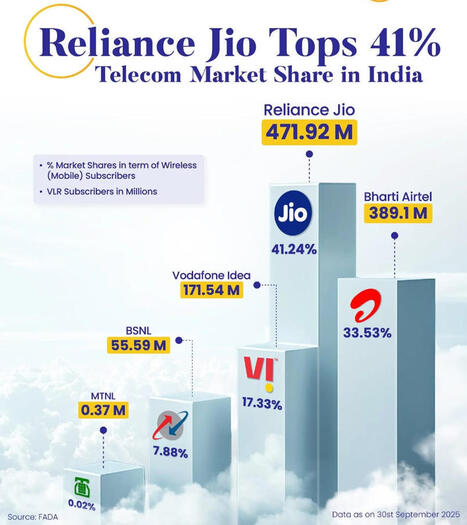

India’s telecom market behaves like a digital continent. It carries volumes that rival entire regions, yet it runs on the lowest revenue per user among major economies. Two operators deliver world-class network performance at a national scale, one operator remains structurally distressed, and a state player anchors policy goals. This mix of extreme usage, thin margins, and relentless investment pressure creates a system that is both remarkable and unstable.

|

Scooped by

Beeyond

November 16, 2025 2:05 PM

|

The reason these collisions keep appearing is that WiFi and cellular no longer occupy separate roles. They chase the same physics, the same mid-band capacity, the same enterprise environments, and the same edge compute opportunities. The Brussels decision is only the most recent signal that the two stacks are converging on the same territory, and every time that happens, the tension becomes visible.

|

Scooped by

Beeyond

November 3, 2025 3:59 AM

|

For more than a decade, the telecom industry has been busy trying to reinvent itself as something it is not. “Techco,” “Servco,” “Digital Operator”, all elegant slogans for an age that believed value came from software and platforms. Telcos sold towers, outsourced data centers, and trimmed engineering ranks to chase cloud partnerships and brand adjacency. It looked modern; it was strategically backward. While telcos were distancing themselves from hardware, the world quietly re-industrialized. AI transformed computing from a software abstraction into a physical process, a factory operation that consumes electricity, produces tokens, and generates cognition. The bottleneck is no longer spectrum or subscriber growth but the energy-to-intelligence ratio: how many joules it takes to deliver a decision. Every major technology company is now an energy company in disguise. Global CapEx tells the story.

|

Scooped by

Beeyond

October 28, 2025 1:09 PM

|

When Nvidia takes a billion-dollar stake in an old-guard telecom vendor, it’s not a financial gesture but a signal. A signal that the AI arms race is moving from datacenters into the network fabric itself. On October 28, 2025, Nokia announced that Nvidia will invest $1 billion in newly issued shares, acquiring roughly 166 million shares, or about 3.5% of the company, and forming a deep strategic alliance to co-develop 6G and AI-native networking technologies. Nokia’s stock jumped 18 % within hours.

|

|

Scooped by

Beeyond

January 28, 9:46 AM

|

Depuis des années, les univers des satellites et des réseaux mobiles semblaient évoluer en totale autonomie. Les premiers, jugés coûteux et réservés aux usages spécialisés, bateaux, avions ou zones reculées – paraissaient inaccessibles au quotidien. Quant aux opérateurs mobiles, leur réseau dense n’allait guère au-delà des villes et des villages, laissant de vastes espaces sans aucune connectivité. Deux modèles économiques distincts, deux langages industriels quasi incompatibles… jusqu’à récemment.

|

Scooped by

Beeyond

January 24, 8:45 AM

|

Davos 2026 marked a clean break for the telecom industry. The industry shifted the discussion away from speed, coverage, and generational labels toward control, autonomy, fragmentation, capital, and geography. Telecom CEOs converged on one reality: Networks are no longer passive infrastructure; they are becoming intelligence systems operating under geopolitical pressure, financial stress, and physical limits. What emerged in the Alps were 5 narratives that will set the roadmap for Telcos in the coming years.

|

Scooped by

Beeyond

January 20, 6:10 AM

|

Telcos attempted multiple monetization strategies without achieving any change in outcome. Quality tiers, zero rating, sponsored data, and later network slicing promised differentiation but failed to command durable price premiums. Enterprises adopted private networks selectively, yet volumes remained insufficient to move group-level revenue. Latency improvements delivered technical gains but limited willingness to pay, since applications abstracted transport and captured the value layer.

Cost per bit continued to fall faster than achievable price increases, driven by silicon scaling, higher-order MIMO, densification, and fiber economics. Transport approached marginal cost behavior while remaining capital-intensive.

|

Scooped by

Beeyond

January 16, 4:51 AM

|

Last week, Bob Sternfels, CEO of McKinsey & Company, stated that the firm has 60,000 employees and that 25,000 of them are AI agents. Not tools or copilots but employees. The wording was deliberate as it places AI agents in the same category as human workers inside an enterprise. That is not a visionary statement; It is a technical bullcrap. Counting AI agents as employees implies equivalence in autonomy, judgment, accountability, and decision ownership. Anyone with a serious background in AI and machine learning knows this equivalence does not exist today, and is not even close to it. What exists are probabilistic systems wrapped in orchestration layers, heavily supervised by humans, brittle under long-horizon execution, and fundamentally incapable of owning outcomes.

|

Scooped by

Beeyond

January 9, 7:39 AM

|

Over the past weeks, I have had long private conversations with five senior telecom analysts. The reason is because I was a dissapointed about many of the latest reports I saw regarding 2026. trends They felt just corporate talk or even sponsored reports. So I wanted to have a honest discussion. What came out of those discussions has very little to do with the trend reports filling our inboxes right now. Those documents are written to keep ecosystems stable, relationships smooth, and marketing budgets justified. This was different. This is where the industry is structurally weak and where 2026 will prompt uncomfortable discussions.

This is not a future-looking hype piece and not a technology wish list. It is a confession-style assessment of what actually matters next year, based on what people say when they stop selling and start thinking.

|

Scooped by

Beeyond

January 6, 2:55 AM

|

Mature assets, strong incumbents, high technical competence, and slow decision cycles. In that environment, advantage no longer comes from owning better infrastructure. It comes from how effectively the organization coordinates what it already owns. Analysts consistently find that, after asset normalization, operating model and decision velocity account for roughly 30-40% of performance variance. Network quality explains survival but does not explain outperformance. Once technical parity is reached, internal friction becomes the dominant tax. Culture here is not about kindness or slogans. It concerns incentives, permissions, ways of working, and coherence.

|

Scooped by

Beeyond

January 2, 6:42 AM

|

Starlink’s decision also comes after the company disclosed in December that one of its satellites suffered an in-orbit anomaly, producing a “small” amount of debris and cutting off communications with the spacecraft at an altitude of about 260 miles. The company said the satellite, one of nearly 10,000 currently in orbit for its broadband internet network, rapidly lost 2.49 miles in altitude, suggesting an internal explosion, in what was described as a rare kinetic accident.

|

Scooped by

Beeyond

December 6, 2025 11:31 AM

|

The next decade forces telecom to abandon human centric assumptions and design a network that can support continuous inference, real time robotics and machine generated traffic at global scale.

|

Scooped by

Beeyond

November 30, 2025 8:46 AM

|

A direct look at the hidden assumptions shaping telco strategy and the truths buried beneath them

|

Scooped by

Beeyond

November 18, 2025 11:26 AM

|

Every week, I collect private confessions from telco CXOs. This time, I pulled together fifteen short stories. Small moments that expose the truths our industry keeps quiet. Real voices. Real pressure. Real mistakes. Real opportunities. A clearer picture of telco emerges one confession at a time. A collection of honest reflections from the people who actually run networks and see the industry from the inside every day.

|

Suggested by

Sidra Jefferi

November 5, 2025 3:23 PM

|

Many avid travelers, campers, and RVers settle on satellite Internet as a solution to the losses in connectivity they experience while traveling through rural and highly remote areas of the United States. However, depending on your needs, satellite Internet plans can be too pricey to be practical. Furthermore, satellite Internet often comes with problems such as high latency and data caps. Before you search for “satellite internet providers near me” again, consider switching to renowned rural 5G/4G LTE Internet provider UbiFi.

|

Scooped by

Beeyond

October 29, 2025 7:37 AM

|

Telco used to be the most exciting place on Earth. We were the people who made the impossible happen. We connected continents, carried the first digital signals, and built mobile networks that turned communication into a human right. We were the engineers who bent physics to our will. Then something happened. We turned into administrators of connectivity. The industry that invented the digital age now spends more time in regulatory filings than in labs.

|

Your new post is loading...

Your new post is loading...