Your new post is loading...

Your new post is loading...

French robotics startup Exotec has raised $90 million in a round of funding led by London-based VC firm 83North. Founded out of Lille in 2015, Exotec develops autonomous industrial robots called Skypods that can move horizontally and vertically, and travel at speeds of up to 9mph. The robots constitute part of a “goods-to-person” picking system designed to improve productivity and reduce strain and physical exertion in human warehouse workers. Ecommerce has boomed in 2020 due in large part to COVID-19, with online merchants seeing a 42% year-on-year increase in sales last month in the U.S. alone — data suggests that the global pandemic has led to an extra $107 billion in online sales since March. This surge in demand is good news for companies such as Exotec, which specialize in equipping large warehouses with the tools to pick and pack orders at scale. The Skypod system comprises four core components. The battery-powered robots use laser scanners to detect obstacles, and can move horizontally along the ground and vertically, enabling them to reach goods stored high up. The storage racks themselves are also part of Exotec’s system, designed to house inventory at up to 32 feet high.

Earlier this year BuiltWorlds released its first ever List highlighting venture investors within the built environment. We saw major names like Brick & Mortar, Tech Stars, and the Autodesk Forge Fund, among other venture funds, accelerators, and strategic investors. It’s time we expand on that.

Silicon Valley giant Apple Inc. on Wednesday confirmed that it is investing $1 billion (approximately Rs 6,793 crore) in Japanese telecom major SoftBank Group’s Vision Fund, an estimated $100-billion (approximately Rs 68 lakh crore) venture that will oversee the development of new technologies. Taiwanese electronics manufacturer Foxconn and the family of the Oracle corporation’s chairman Larry Ellison are also expected to invest in the fund, the Wall Street Journal reported. Apple believes the move “will help ‘speed the development of technologies that may be strategically important” to it, company spokesperson Kristin Huguet said. Apple has rarely ever invested in venture capital companies before. While SoftBank will itself invest approximately $25 billion (approximately Rs 17 lakh crore) in its Vision Fund, it will be back largely by the Saudi Arabian government. American telecom equipment company Qualcomm Inc is also expected to put in an investment. The SoftBank Vision Fund is expected to close its fundraising efforts by mid-2017.

Blockstream has raised $55m in Series A funding to continue its work expanding the bitcoin code base for commercial use.

With the news, Blockstream's total funding rises to $76m over two investment rounds. To date, the company's signature technology has been its sidechains offering, currently in testing, which enables the creation of blockchains that can validate data from, and transfer assets to, other blockchains.

Blockstream’s round was led by venture capital firms AXA Strategic Ventures, the venture capital arm of French multinational insurance firm AXA Group; Digital Garage, the Tokyo-based online payments firm co-founded by Joi Ito; and Hong Kong venture capital firm Horizons Ventures.

AME Cloud Ventures, Blockchain Capital and Future\Perfect Ventures were among other investment firms that participated in the deal.

Given the recent interest in private and permissioned blockchains, Blockstream sought to underscore the versatility of its technology as well as its early efforts to bring added functionality to the bitcoin network through interoperable blockchains.

Blockstream CEO Austin Hill told CoinDesk:

"We were one of the first companies that painted a vision for interoperable blockchains, that there wasn’t going to be one blockchain, but many of them, all building off the bitcoin codebase to deliver the technology."

Still, Hill said the company remains dedicated to developing technology for the open-source bitcoin blockchain, which it called the "most mature, well-tested and secure" infrastructure for blockchain services.

"What we would hate to see happen is the most robust and secure blockchain protocol getting left by the wayside if people moved on to different protocols and tech stacks that bitcoin isn’t designed for," Hill continued, adding:

"We believe there is a benefit to society to have all these blockchains be interoperable."

U.S. startups have traditionally had access to far higher levels of investment, giving them a head start when it comes to research and development and making it easier to attract to its shores the very best talent. Yet the arms race is becoming closer. According to Dow-Jones VentureSource, the second quarter of 2014 saw over €2.1 billion ($2.4 billion at the current conversion rate) raised by European startups — the highest quarterly total since 2001. (For comparison’s sake, the figure for U.S.-based startups in that period was $13.8 billion.) Encouraged by the success of European tech firms such as Shazam and Transferwise — both of which made valuations of billion dollars in early 2015 — more U.S. money is crossing the pond. There is also an increasing confidence in investors that Europe has the talent pool to thrive, and there has not been an irreparable “brain drain” to Silicon Valley.

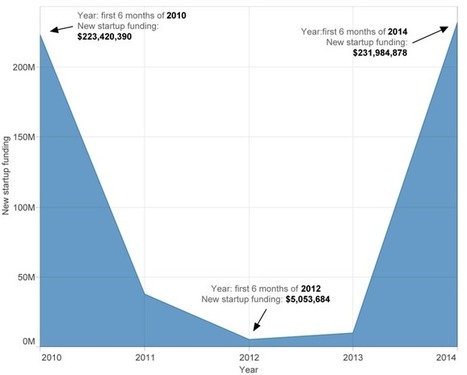

Over the past few years the semiconductor funding ecosystem experienced a downturn. According to the GSA survey, there were only five Series A semiconductor funding rounds and 10 exits in 2010 in North America, Europe and Israel. Most of the VCs who invested in semiconductors shifted their focus to software startups due to higher scalability, faster time-to-exit and low cost of failure. However, I believe semiconductor funding hit bottom in 2013, and it is slowly coming back. I analyzed publicly available transaction data from CrunchBase and discovered promising insights about recent funding trends.

Fred Destin has had a big 24 hours. The tech investor said Wednesday he would jump firms, from Atlas Venture in the U.S. to Accel Partners' London office. On Thursday morning, one of his leading investments for Atlas, UK-property listing site Zoopla, announced it would go public.

Scoop.it, a leading social curation publishing hub, today announced it has raised $2.6 million. Visited by more than 75 million people worldwide in just 18 months since its launch in 2011, Scoop.it's success has led to the appointment of a new executive, Andrew Federici, as vice president of monetization to increase Scoop.it's growing base of paid customers. Scoop.it pivoted two and a half years ago from an application mobile technology called Goojet, which received the initial funding of a seed and partial Series A round. Altogether, Goojet and Scoop.it have raised $13.6 million including the recent addition of$2.6 million from Partech International, Elaia Partners, IXO Private Equity and Orkos Capital. "Since launch 18 months ago, we have seen our user traction grow on our platform and freemium services," said Scoop.it co-founder and CEO, Guillaume Decugis. "We felt it was time to accelerate the delivery of value-added premium features to our paid users, and we hired Andrew Federici because of his expertise in product monetization and his impressive media background."

Every VC firm has its own way of evaluating potential investments. Remmy Oxley, an anonymous VC, says that Moneyball-style methods are the next step, and reveals his firm's algorithm for screening candidates.

Of the 6,613 U.S.-based companies initially funded by venture capital between 2006 and 2011, 84% now are closely held and operating independently, 11% were acquired or made initial public offerings of stock and 4% went out of business, according to Dow Jones VentureSource. Less than 1% are currently in IPO registration.

Dans le cadre du Programme d’investissements d’avenir (PIA), le FNA été mis en place pour soutenir les entreprises qui développent des innovations technologiques en leur apportant des fonds propres à un stade très précoce. Doté de 400 M€, le FNA réalise des investissements dans des fonds d’amorçage gérés par des équipes de gestion professionnelles et qui réalisent eux-mêmes des investissements dans de jeunes entreprises innovantes en phases d’amorçage et de démarrage. Il ne finance pas directement des entreprises

Technocom 2, doté de plus de 30 M€ à l’issue de ces engagements, financera pour des montants allant de quelques centaines de milliers à plusieurs millions d’euros des créations d’entreprises issues de la recherche publique, académique ou industrielle française, dans les technologies numériques appliquées aux réseaux, à l’énergie, à la maison intelligente et à la santé. Technocom 2 prévoit de financer et d’accompagner une quinzaine de jeunes entreprises à fort potentiel de croissance.

|

Exotrail défie la gravité et s'affirme comme un leader français et européen du #NewSpace

When a magazine challenged a technology company to use AI to pick 50 unheard of companies that were set to flourish, the experiment yielded dramatic results. In 2009, Ira Sager of Businessweek magazine set a challenge for Quid AI's CEO Bob Goodson: programme a computer to pick 50 unheard of companies that are set to rock the world. The domain of picking “start-up winners” was - and largely still is - dominated by a belief held by the venture capital (VC) industry that machines do not play a role in the identification of winners. Ironically, the VC world, having fuelled the creation of computing, is one of the last areas of business to introduce computing to decision-making. Nearly eight years later, the magazine revisited the list to see how “Goodson plus the machine” had performed. The results surprised even Goodson: Evernote, Spotify, Etsy, Zynga, Palantir, Cloudera, OPOWER – the list goes on. The list featured not only names widely known to the public and leaders of industries, but also high performers such as Ibibo, which had eight employees in 2009 when selected and now has $2 billion annual sales as the top hotel booking site in India. Twenty percent of the companies chosen had reached billion-dollar valuations. To contextualize these results, Bloomberg Businessweek turned to one of the leading “fund of funds” in the US, which has been investing in VC funds since the 1980s and has one of the richest data sets available on actual company performance and for benchmarking VC portfolio performance. The fund of funds was not named for compliance reasons, but its research showed that, had the 50 companies been a VC portfolio, it would have been the second-best-performing fund of all time. Only one fund has ever chosen better, which did most of its investments in the late 1990s and rode the dotcom bubble successfully. Of course, in this hypothetical portfolio, one could choose any company, whereas VCs often need to compete to invest.

Venture capitalists who are serious about turning their firms into more than one-fund wonders may want to have their associates actually start and run a company for a year. Running a company is distinctly different from simply having operating experience (working in business development, sales or marketing). None of that can compare with being the CEO of a startup facing a rapidly diminishing bank account, your best engineer quitting, working until 10 p.m. then rushing to the airport to catch a redeye to close a deal with a customer, with your board demanding you do it faster. Today, you can start a web-mobile-cloud startup for $500,000 and have money left over. Every potential early-stage venture capitalist should take a year and do it before he or she makes partner. Here’s why. Venture capital as a profession is less than half a century old. It is still very much a “craft” business. Over time, venture firms realized that the firm’s partners need a variety of skills: - Deal-picking skills (recognizing the right combination of founder and market opportunity).

- Rolodex-deal flow (deal-sourcing ability to make connections for the portfolio).

- People skills (recognizing patterns of success in individuals and teams).

- Board skills (startup coaching, mentoring, growth strategy, daily operations).

- Market-technology acuity (domain expertise).

- Fundraising skills.

Some of these skills are learned in school (finance), some are innate aptitudes (people skills), some are learned pattern-recognition skills (shadowing experienced partners, hard-won success and failures of their own), and some are learned by having operating experience. But none of them are substitutes for having started and run a company. How to Become a VC

. Early-stage venture-capital firms grow their partnerships in different ways, some hire: - Partners from other firms.

- Associates and put them on a career path that makes becoming a VC a profession not just a craft.

- Venture-operating partners to get them into new industries.

- An executive who had startup “operating experience.”

- Rarely, a startup founder-CEO.

Fred Wilson says blockchain technology will create the next Google or Facebook. But in the end, the disruption could be to our entire economic system.

He wonders in not-so vague terms if the blockchain technology which underlies bitcoin, might actually mean an end to “network effects” that let bigger companies create better value for their customers, and more.

“Lately, we’ve been wondering if there is an end to this pattern on the Internet and mobile,” wrote Wilson, who in addition to being an investor in bitcoin exchange Coinbase, was an early investor in Twitter and Tumblr.

“We think it is possible that an open-data platform, in which users ultimately control their data and the networks they choose to participate in, could be the thing that undoes this pattern of winner takes most,” he writes.

At this initial stage, IdeaMarket will award 5 percent equity in the nascent venture to the idea originator and 5 percent to members of the crowd who meaningfully improved the idea during the comment period. Initial investors, which may include IdeaMarket and/or IdeaLab, will get as much as 20 percent depending on the amount they invest and IdeaMarket will get “a small piece,” in Gross’ words, that will vary from deal to deal in return for facilitating this matchmaking process. Founding teams will therefore be left 60 to 70 percent of these companies, a fairly standard figure for accelerator-stage companies with some early angel investment. It’s not unheard of for investors to publish problems or ideas that they’d like to back. Y Combinator’s Paul Graham famously published seven such “frighteningly ambitious startup ideas” in 2012, a list that includes the next great search engine and a replacement for traditional universities. Just last week, prolific angel investor Jason Calacanis wrote his tens of thousands of email subscribers to suggest a “Lord of the Flies, Battle Royale gauntlet” over fixing the market for residential real estate reviews. In perhaps the most spectacular example, last summer, Elon Musk published his initial designs for the Hyperloop, a ultra-high speed modern transportation system, and invited anyone with the ability and the inclination to take a crack at making it a reality.

Paris-based long-distance ride-sharing startup BlaBlaCar announced a $100 million Series C funding round led by Index Ventures today. As part of the round, Index’s Dominique Vidal and Martin Mignot will be joining the board. Here, Dominique and Martin explain why Index is so excited about what lies ahead for the company. The best consumer companies tend to be the simplest. They do one thing particularly well. So well, in fact, that its customers soon take them for granted, and forget that they ever lived without them, and that the premise the company is based on, was once viewed as unthinkable, even slightly ridiculous. BlaBlaCar falls squarely into that category.

Rouen-based startup Bunkr has raised €1 Million from IDInvest (led by Matthieu Baret), Daniel Mahrely & Xavier Niel for their collaborative online presentation tool. The company, whose launch we first covered in May 2013, has seen amazing traction in the last 12 months, growing in the first few months to over 35,000 users, thanks largely to their launch and branding as a “Powerpoint Killer” coinciding with Microsoft co-founder & CEO Steve Ballmer’s resignation announcement last year.

Accel Partners, which has invested in Cloudera, Fusion-io and RelateIQ, is making a further big push into big data, as it announces the creation of a second fund focused on startups that are storing, analyzing and harnessing the power of data analytics. The funding for the $100 million Big Data Fund 2 will come from Accel’s other investment vehicles worldwide, including Accel London IV, a new $475 million European and Israeli tech-focused fund that was announced in April.

Interesting cross-pond analysis of the "pigeons revolt" by Jean-Louis who writes that "Considering sex and money, Americans and French cultures exhibit truly polar opposite behaviors. The French see nothing wrong with a President having a wife, a mistress and a love child, they revel in sexual and often sexist jokes. But, if you ask someone how much they paid for their apartment, they’ll react as if you’d touched them in boundary-breaking ways. Conversely, they perceive us Americans as demonizing sex — think a past President and his “oral” office — while being obscene with money."

Avec l'entrée en Bourse de Facebook, et sa capitalisation supérieure à $100bn, une question est sur toutes les lèvres : « à quand un Facebook français ? ». La réponse est simple: ce n’est pas pour demain, voire même jamais si nous ne créons pas vite un écosystème favorable.

Belle analyse de Jean-David CHAMBOREDON, toujours aussi pertinent...

|

Your new post is loading...

Your new post is loading...

Interestingly, Exotec differentiates from Kiva as it operates in 3D, and is deployed through a system approach.